📢 SMIC 2025: What is the new amount and how much will you earn after taxes?

The French minimum wage (SMIC) changes every year to keep pace with inflation and guarantee a minimum purchasing power for workers. In 2025, the SMIC will be increased again. But in concrete terms, how much will you receive on your paycheck after social security contributions and income tax have been deducted, with a gross salary of €1,802?

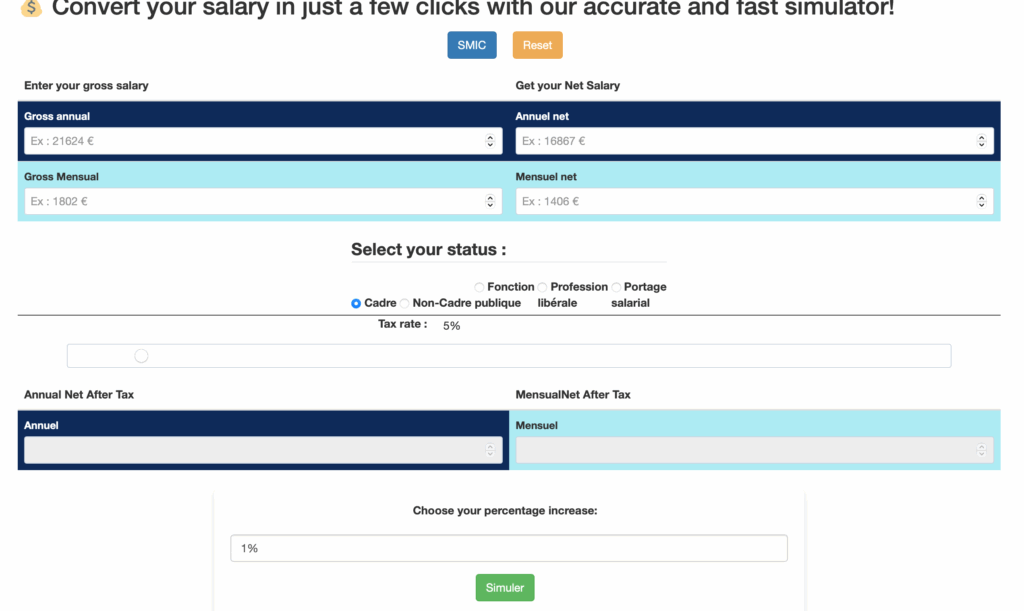

💡 Use our gross-to-net simulator to find out your exact salary based on your status and the deductions that apply. 👉 Try it out !

📊 Minimum wage in 2025: €1,802 gross and net

🔹 SMIC 2025 : new amount

If you’re wondering what a gross salary of €1,802 corresponds to in net terms, you’ve come to the right place! The minimum wage is adjusted each year in line with inflation and economic growth. In 2025, it will reach:

- Net hourly minimum wage: €9.40

- Gross hourly minimum wage: €11.88

- Gross monthly minimum wage (35 hours): approximately €1,802 (€1,801.80)

- Estimated net monthly minimum wage: approximately €1,426 (€1,426.30 before payroll tax).

This data allows you to compare your remuneration with the current legal minimum wage.

The minimum wage in France was increased by 2% on November 1, 2024, bringing the gross hourly minimum wage to €11.88. For a 35-hour week, this equates to a gross monthly minimum wage of €1,801.80. More information can be found in this article from Le Monde. This gives a gross monthly SMIC of €1,802, which must be converted to net.

After deduction of social security contributions, the net monthly SMIC is estimated at around €1,426.30 (before withholding tax).

📌 Please note: The exact amount of the net minimum wage depends on payroll taxes.

💰 🔎 Calculate your net salary now with our tool ➡️ Try our simulator

📈 Why is the minimum wage increasing?

Several factors influence increases in the minimum wage:

- Inflation: The government adjusts the minimum wage in line with the rise in the cost of living (normally).

- Changes in purchasing power: The aim is to ensure that workers have a sufficient minimum income.

- Social negotiations: Social partners play a key role in the annual revaluation.

💡 Minimum wage and purchasing power: what will be the impact in 2025 (1802 gross and net)?

The increase in the minimum wage has direct effects on several aspects:

- ✅ Increase in low wages: All wages indexed to the minimum wage are adjusted.

- ✅ Increase in social assistance: Certain benefits are calculated on the basis of the minimum wage.

- ✅ Impact on contributions: An increase in the minimum wage may slightly increase certain payroll costs.

📢 Take stock of your situation and estimate your future salary with our gross/net simulator! 🔽

👉 Try the gross-to-net calculator to find out the net value of your gross salary of 1802.

📊 Comparison of SMIC 2024 vs SMIC 2025

| Year | Gross monthly minimum wage (SMIC) | Monthly net minimum wage* (SMIC) |

|---|---|---|

| 2024 | 1792 € | 1398,69 € |

| 2025 | 1802 € | 1426,30 € |

📌 *Average estimate based on typical payroll costs.

💼 Who will be affected by the minimum wage in 2025, with a gross amount of 1,802 and a net amount of 1,402?

The minimum wage applies to all employees, with some exceptions. It applies in particular to:

- Employees on permanent contracts, fixed-term contracts, and apprentices 💼

- Temporary and seasonal workers 📆

- Interns who are not subject to the minimum wage but may be eligible for compensation

💡 Specificity: Apprentices and work-study students have a reduced salary based on their age and year of training. Read our article to find out more about Net Apprentice Salary France: Understanding Gross and Net.

📢Conclusion: Take advantage of the increase in the minimum wage to optimize your purchasing power!

The increase in the minimum wage in 2025 is good news for low-income employees. To find out exactly how much you will earn after tax, use our gross-to-net calculator and compare different remuneration scenarios.

💰 💡 Try our tool now to find out the value of your gross salary 1802 in net terms.

FAQ – SMIC 1802 brut to net

What is the net minimum wage in 2025?

- Net hourly minimum wage: €9.40

- Gross hourly minimum wage: €11.88

- Gross monthly minimum wage (35 hours): approximately €1,802 (€1,801.80)

- Estimated net monthly minimum wage: approximately €1,426 (€1,426.30 before payroll tax).

What is the hourly minimum wage?

- Net hourly minimum wage: €9.40

- Gross hourly minimum wage: €11.88

#SMIC2025 #Salary #BrutNet